19.2 Solution

Before we begin a few short definitions that we will use here (so that we are on the same page).

- principal - the money you borrow form a bank

- interest - the money you pay extra (except for the money you borrowed)

- interest rate - a percentage of principal which you will pay as interest

- installment - fixed monthly payment to the bank in order to cover you debt, part of it goes to pay off the principal and part to pay the interest

Next, let’s use the formatting function from Section 18.2.

# getFormattedMoney from chapter: compound interest, modified

function fmt(money::Real, sep::Char=',',)::Str

@assert money >= 0 "money must be >= 0"

amount::Str = round(Int, money) |> string

result::Str = ""

counter::Int = 0

for digit in reverse(amount) # digit is a single digit (type Char)

if counter == 3

result = sep * result

counter = 0

end

result = digit * result

counter += 1

end

return result * " USD"

endTime to define a struct that will contain the data necessary to perform calculations for a given mortgage.

struct Mortgage

principal::Real

interestPercYr::Real

numMonths::Int

Mortgage(p::Real, i::Real, n::Int) = (

p < 1 || i < 0 || n < 12 || n > 480) ?

error("incorrect field values") : new(p, i, n)

end

mortgage1 = Mortgage(200_000, 6.49, 20*12)

mortgage2 = Mortgage(200_000, 4.99, 30*12)Finally, we are ready to calculate our monthly payment to the bank.

# calculate c - money paid to the bank every month

function getInstallment(m::Mortgage)::Flt

p::Real = m.principal

r::Real = m.interestPercYr / 100 / 12

n::Int = m.numMonths

if r == 0

return p / n

else

numerator::Flt = r * p * (1+r)^n

denominator::Flt = ((1 + r)^n) - 1

return numerator / denominator

end

endAll the formulas are based on this Wikipedia’s page. Notice that the function’s arguments (and Mortgage fields) contain longer (more descriptive) names, whereas inside the functions we use the abbreviations (case insensitive) found in the above-mentioned formulas .

With that done, we can answer how much money we will have to pay to the bank every month for the duration of our mortgage.

(

getInstallment(mortgage1) |> fmt,

getInstallment(mortgage2) |> fmt

)("1,490 USD", "1,072 USD")The money we still owe to the bank (principal) will change month after month (because every month we pay off a fraction of it with our installment), so let’s calculate that.

# amount of money owed after every month

function getPrincipalAfterMonth(prevPrincipal::Real,

interestPercYr::Real,

installment::Flt)::Flt

@assert((prevPrincipal >= 0 && interestPercYr >= 0 && installment > 0),

"incorrect argument values")

p::Real = prevPrincipal

r::Real = interestPercYr / 100 / 12

c::Flt = installment

return (1 + r) * p - c

endNot much to explain here, just a simple rewrite of the formula into Julia’s code (first we increase the principal by interest, then we subtract the installment from it). Now we can estimate the principal owed to the bank each year.

# paying off mortgage year by year

# returns principal still owed every year

function getPrincipalOwedEachYr(m::Mortgage)::Vec{Flt}

monthlyPayment::Flt = getInstallment(m)

curPrincipal::Real = m.principal

principalStillOwedYrs::Vec{Flt} = [curPrincipal]

for month in 1:m.numMonths

curPrincipal = getPrincipalAfterMonth(

curPrincipal, m.interestPercYr, monthlyPayment)

if month % 12 == 0

push!(principalStillOwedYrs, curPrincipal)

end

end

return principalStillOwedYrs

endHere we calculate the principal owed after every month, and once a year (month % 12 == 0) we push it to a vector tracking its yearly change (principalStillOwedYrs). Let’s see how it works, if we did it right then in the end the principal should drop to zero (small rounding errors possible).

principals1 = getPrincipalOwedEachYr(mortgage1)

principals2 = getPrincipalOwedEachYr(mortgage2)

(

principals1[end],

principals2[end],

round(principals1[end], digits=2),

round(principals2[end], digits=2)

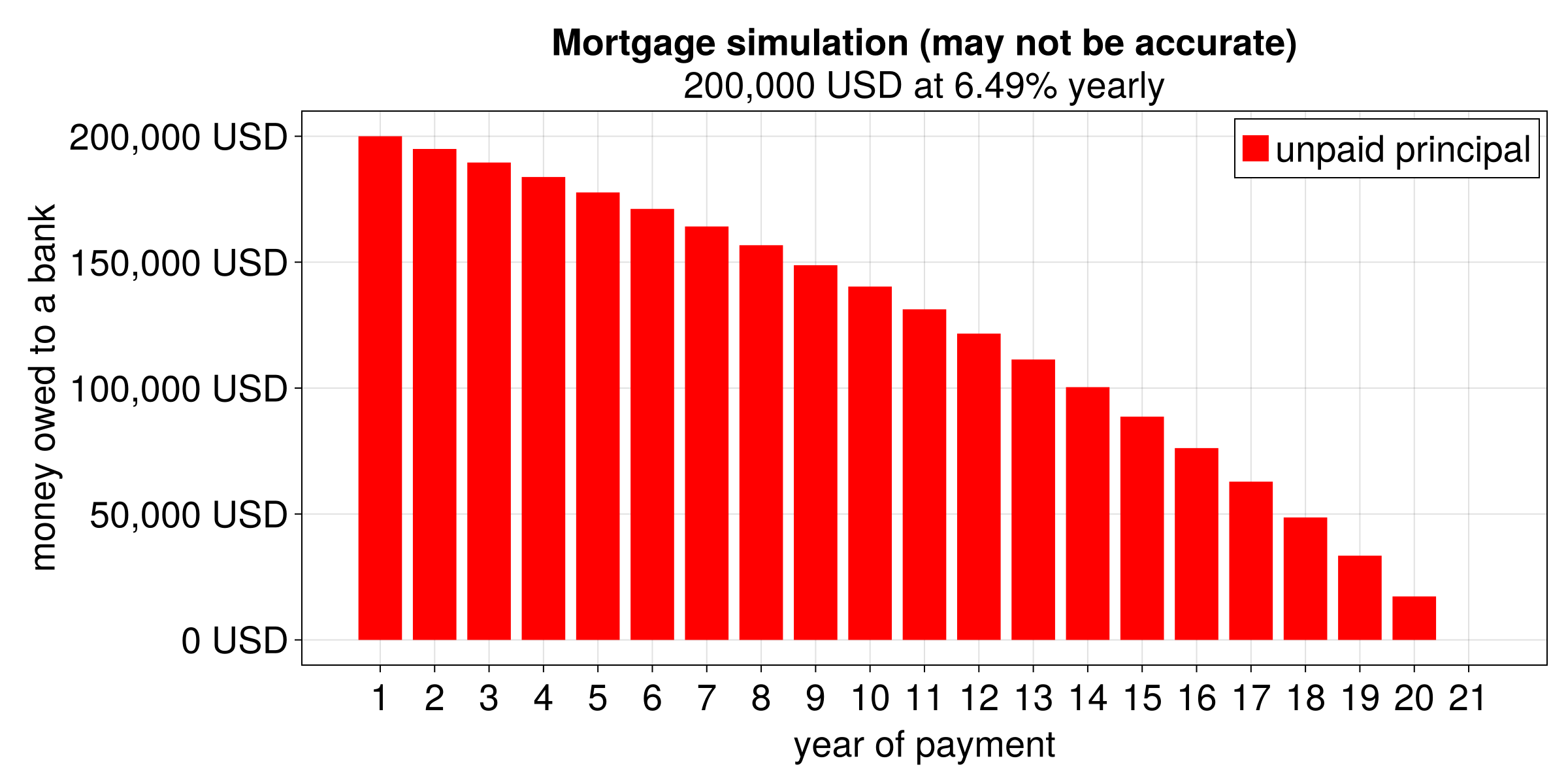

)(-1.1685642675729468e-8, -1.4030092643224634e-8, -0.0, -0.0)So how much principal we still owe to the bank at the beginning of year 15 in each scenario?

(

principals1[15] |> fmt,

principals2[15] |> fmt

)("88,661 USD", "141,638 USD")Hmm, quite a lot (remember we borrowed $200,000 for 20 and 30 years). And when will this value drop to \(\le\) 100,000 USD (\(\le\) half of what we borrowed)?

(

findfirst(p -> p <= 100_000, principals1),

findfirst(p -> p <= 100_000, principals2)

)(15, 22)In general, for quite some time the money we pay to the bank mostly pay off the interest and not the principal, so that it drops slowly at first (see Figure 5).

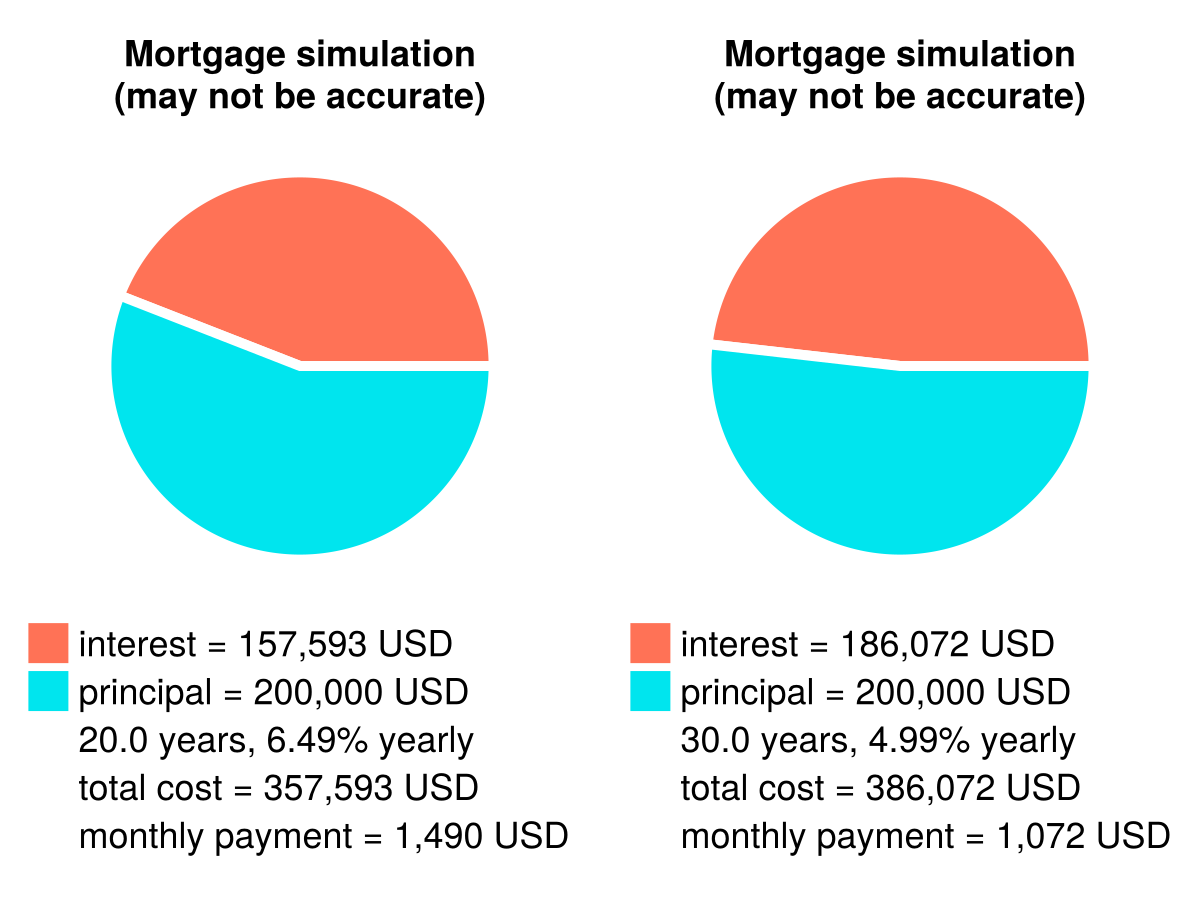

To answer the last question (which mortgage is more worth it for us in terms of total payment and total interest) we’ll use a pie chart.

function addPieChart!(m::Mortgage, fig::Cmk.Figure, ax::Cmk.Axis, col::Int)

installment::Flt = getInstallment(m)

totalInterest::Flt = installment * m.numMonths - m.principal

yrs::Flt = round.(m.numMonths / 12, digits=2)

colors::Vec{Str} = ["coral1", "turquoise2", "white", "white", "white"]

lebels::Vec{Str} = ["interest = $(fmt(totalInterest))",

"principal = $(fmt(m.principal))",

"$(yrs) years, $(m.interestPercYr)% yearly",

"total cost = $(fmt(installment * m.numMonths))",

"monthly payment = $(fmt(installment))"]

Cmk.pie!(ax, [totalInterest, m.principal], color=colors[1:2],

radius=4, strokecolor=:white, strokewidth=5)

Cmk.hidedecorations!(ax)

Cmk.hidespines!(ax)

Cmk.Legend(fig[3, col],

[Cmk.PolyElement(color=c) for c in colors],

lebels, valign=:bottom, halign=:center, fontsize=60,

framevisible=false)

return nothing

endThe function is rather simple. It adds a pie chart to an existing figure and axis. A point of notice, the colors used are ["coral1", "turquoise2", "white", "white", "white"]. The first two will be used to paint the circle. But all of them, will be used in the legend (Cmk.Legend). Hence, we used "white" for the values that are not in the circle (white color on a white background in the legend is basically invisible). We also used string interpolation where a simple interpolated value is placed after the dollar character ($) or in a more complicated case (a structure field, a calculation) it is put after the dollar character and within parenthesis (e.g. $(2*3)).

Time to draw a comparison

function drawComparison(m1::Mortgage, m2::Mortgage)::Cmk.Figure

fig::Cmk.Figure = Cmk.Figure(fontsize=18)

ax1::Cmk.Axis = Cmk.Axis(

fig[1:2, 1], title="Mortgage simulation\n(may not be accurate)",

limits=(-5, 5, -5, 5), aspect=1)

ax2::Cmk.Axis = Cmk.Axis(

fig[1:2, 2], title="Mortgage simulation\n(may not be accurate)",

limits=(-5, 5, -5, 5), aspect=1)

Cmk.linkxaxes!(ax1, ax2)

Cmk.linkyaxes!(ax1, ax2)

addPieChart!(m1, fig, ax1, 1)

addPieChart!(m2, fig, ax2, 2)

return fig

end

drawComparison(mortgage1, mortgage2)

So it turns out that despite the higher interest rate of 6.49% overall we will pay less money to the bank for mortgage1. Therefore, if we are OK with the greater monthly payment (installment) then we may choose that one.

Of course, all the above was just a programming exercise, not a financial advice. Moreover, the simulation is likely to be inaccurate (to a various extent) for many reasons. For instance, a bank may calculate the interest every day, and not every month, in that case you will pay more. Compare with the simple example below and the compound interest from Section 18.2.1.

# 6% yearly, after 1 year

(

200_000 * (1 + 0.06) |> fmt, # capitalized yearly

200_000 * (1 + (0.06/12))^12 |> fmt, # capitalized monthly

200_000 * (1 + (0.06/365))^365 |> fmt, # capitalized daily

)("212,000 USD", "212,336 USD", "212,366 USD")Anyway, once you know what’s going on, it should be easier to modify the program to reflect a particular scenario more closely.