20.2 Solution

There’s no need to (completely) reinvent the wheel so we will use Mortgage, fmt and getInstallment we developed earlier (see Section 19.2). Just in case be sure to also check the terminology we defined there. Anyway, the first function we’ll define in this chapter is payOffMortgage

# single month payment of mortgage, returns

# (remainingPrincipal, pincipalPaid, interestPaid)

function payOffMortgage(

m::Mortgage, curPrincipal::Real, installment::Real,

overpayment::Real)::Tuple{Real, Real, Real}

interestDecimalMonth::Real = m.interestPercYr / 100 / 12

interestPaid::Real = curPrincipal * interestDecimalMonth

principalPaid::Real = installment - interestPaid

newPrincipal::Real = curPrincipal - principalPaid

return (newPrincipal - overpayment,

principalPaid + overpayment, interestPaid)

endThe function accepts (among others) curPrincipal, installment and overpayment and does a payment for a single month. To that end, first we calculate the monthly interest rate as a decimal (interestDecimalMonth) and use it to calculate the interest principal paid this month (interestPaid and principalPaid). Afterwards we calculate our the new, lower, principal (newPrincipal). Finally, we return a tuple with 3 values: 1) the remaining principal (after a month), 2) principal paid in a given month (from installment and overpayment), and 3) interest paid (from installment). The remaining principal is newPrincipal - overpayment. The principal that we paid off this month is principalPaid and overpayment. The interest paid this month is just interestPaid.

Right away we see a reason or two why our function is likely not to be accurate. For once, we lack the rounding of money to 2 decimal points (as a bank would do). Secondly, a bank may charge a fee (or some money named otherwise) for every overpayment we make. Still, since all this section is just a programming exercise and not a financial advice then we will not be bothered by that fact.

Still, we will improve our payOffMortgage a bit, by dealing with some edge cases: 1) when curPrincipal is 0 or negative (if curPrincipal <= 0.0 below), 2) when curPrincipal is equal to or smaller than the principal paid in installment (if curPrincipal <= principalPaid below), and 3) when (if newPrincipal <= overpayment below). Therefore, our payOffMortgage will look something like:

# single month payment of mortgage

# (remainingPrincipal, pincipalPaid, interestPaid)

function payOffMortgage(

m::Mortgage, curPrincipal::Real, installment::Real,

overpayment::Real)::Tuple{Real, Real, Real}

if curPrincipal <= 0.0

return (curPrincipal, 0.0, 0.0)

end

interestDecimalMonth::Real = m.interestPercYr / 100 / 12

interestPaid::Real = curPrincipal * interestDecimalMonth

principalPaid::Real = installment - interestPaid

if curPrincipal <= principalPaid

return (0.0, curPrincipal, interestPaid)

end

newPrincipal::Real = curPrincipal - principalPaid

if newPrincipal <= overpayment

return (0.0, newPrincipal + principalPaid, interestPaid)

end

return (newPrincipal - overpayment,

principalPaid + overpayment, interestPaid)

endOnce we can pay it off for a month, we can pay it off completely and summarize it. First, summary:

struct Summary

principal

interest

months

Summary(p::Real, i::Real, m::Int) = (

p < 1 || i < 0 || m < 12 || m > 480) ?

error("incorrect field values") : new(p, i, m)

endNow, for the complete mortgage pay off.

# pay off mortgage fully, with overpayment

function payOffMortgage(

m::Mortgage,

overpayments::Dict{Int, <:Real})::Summary

installment::Real = getInstallment(m) # monthly payment

princLeft::Real = m.principal

princPaid::Real = 0.0

interPaid::Real = 0.0

totalPrincPaid::Real = 0.0

totalInterestPaid::Real = 0.0

months::Int = 0

for month in 1:m.numMonths

if princLeft <= 0

break

end

months += 1

princLeft, princPaid, interPaid = payOffMortgage(

m, princLeft, installment, get(overpayments, month, 0))

totalPrincPaid += princPaid

totalInterestPaid += interPaid

end

return Summary(totalPrincPaid, totalInterestPaid, months)

end

# pay off mortgage according to the schedule, no overpayment

function payOffMortgage(m::Mortgage)::Summary

return payOffMortgage(m, Dict{Int, Real}())

endWe begin, by defining a few variables. For instance, princLeft will hold principal sill left to pay after a month, princPaid will contain the value of principal paid off in a given month, intrPaid will store the interest paid to a bank in a given month. The above will be used in the for loop and will change month by month. Next, the variables that will be used in the Summary struct returned by our function (totalInterestPaid, totalInterestPaid, months). In the for loop we pay off the mortgage month by month. If there is no principal to be paid off (if princLeft <= 0) we break early. Otherwise, we update the number of months, totalPrincPaid, and totalInterestPaid. Notice, that we obtain the over-payment for a month from the overpayments dictionary, where the default over-payment (if the key doesn’t exist) is 0 (get(overpayments, month, 0)).

Let’s do a quick sanity check. Previously (Section 19.2), we said that the regular payment off mortgage1 ($200,000 at 6.49% for 20 years) will roughly yield the principal of $200,000 and the interest of $157,593. Let’s see if we get that.

payOffMortgage(mortgage1)Summary(199999.99999999988, 157592.5713666817, 240)OK, so finally, we are ready to answer our questions.

How much money can we potentially save in the case of mortgage1 ($200,000, 6.49%, 20 years) (see Section 19.2) overpaid regularly every month with $200.

function getTotalCost(s::Summary)::Real

return s.principal + s.interest

end

function getTotalCostDiff(m::Mortgage,

overpayments::Dict{Int, <:Real})::Real

s1::Summary = payOffMortgage(m)

s2::Summary = payOffMortgage(m, overpayments)

return getTotalCost(s1) - getTotalCost(s2)

endAnd (here we use comprehensions with a dictionary):

getTotalCostDiff(mortgage1,

Dict(i => 200 for i in 1:mortgage1.numMonths)) |> fmt37,444 USD

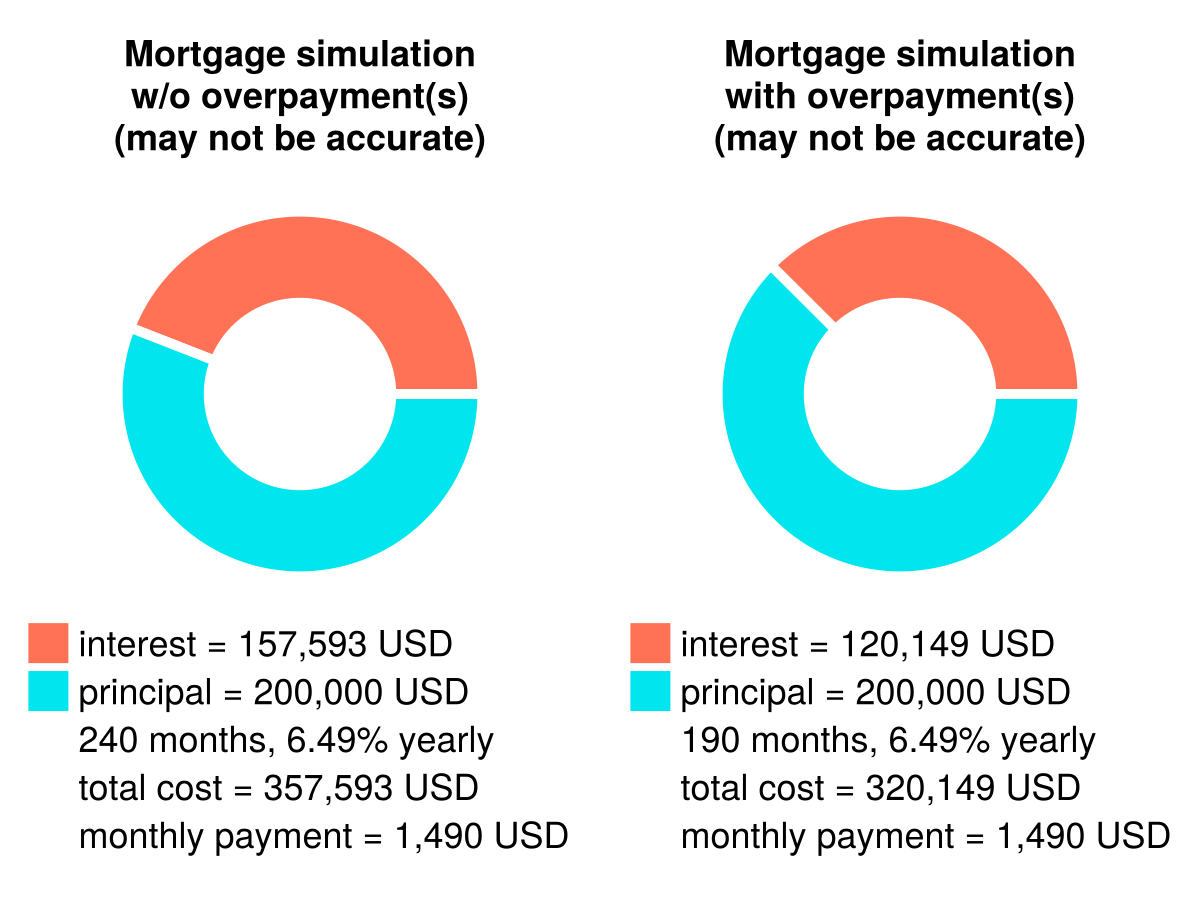

Quite a penny (see also Figure 7).

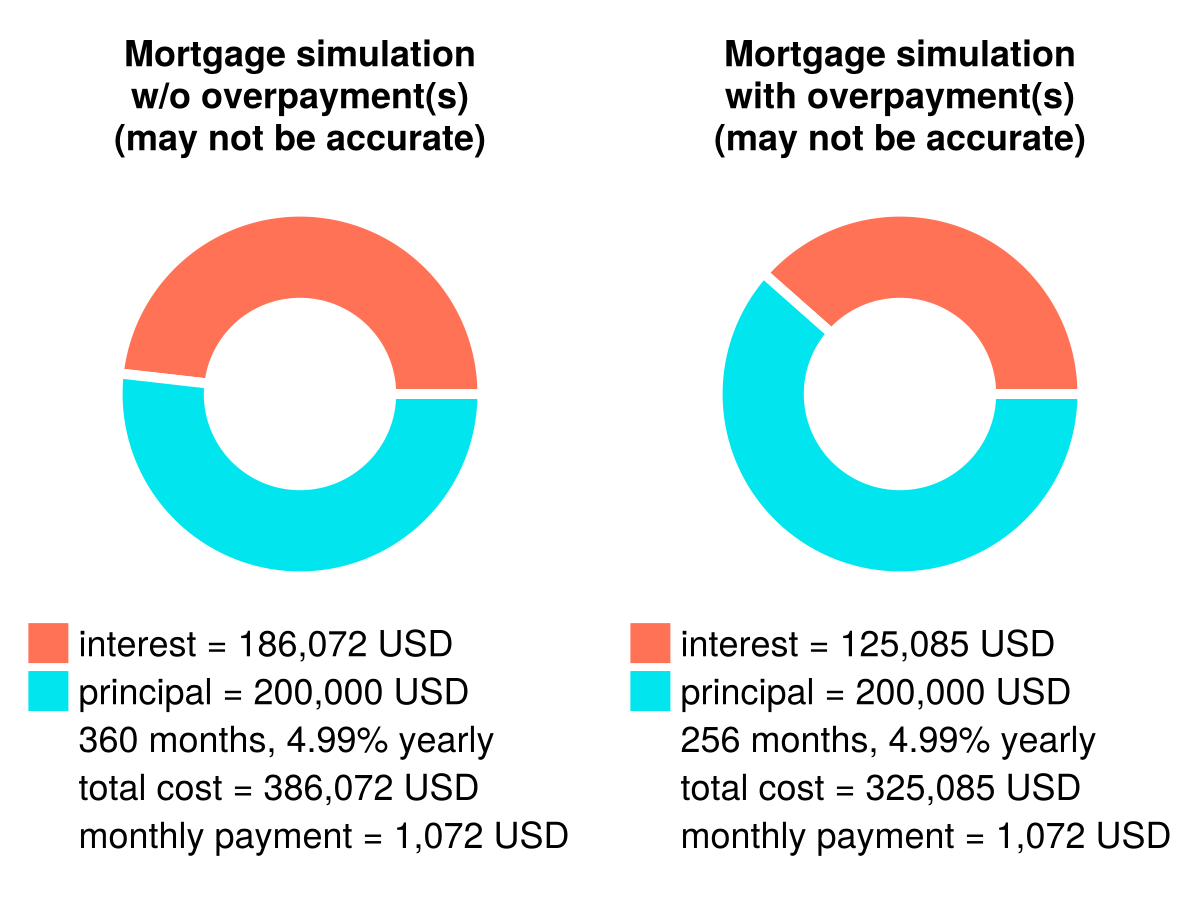

And now let’s overpay mortgage2 ($200,000, 4.99%, 30 years) with $200 monthly.

getTotalCostDiff(mortgage2,

Dict(i => 200 for i in 1:mortgage2.numMonths)) |> fmt60,987 USD

The total savings appear to be even greater than for mortgage1, still the total cost seems to be greater for the overpaid mortgage2 (see Figure 7 and Figure 8).

OK, time for the next question.

For mortgage1 which one is more worth it: to overpay it every month with $200 or to overpay it only once, let’s say in month 13, with $20,000?

(

getTotalCostDiff(mortgage1,

Dict(i => 200 for i in 1:mortgage1.numMonths)) |> fmt,

getTotalCostDiff(mortgage1, Dict(13 => 20_000)) |> fmt

)("37,444 USD", "40,972 USD")Interesting, the above output indicates that we would be able to save more, with an early (month 13) over-payment of a vast sum of money ($20,000, 10% of our initial principal) than just by regularly overpaying the mortgage with small sums of it ($200, 1% of our initial principal).

Out of pure curiosity, let’s see how much we could save when we combine the two (we overpay $200 every month, except for month 13, where we overpay $20,000)

customOverpayments = Dict(i => 200 for i in 1:mortgage1.numMonths)

customOverpayments[13] = 20_000

getTotalCostDiff(mortgage1, customOverpayments) |> fmt65,257 USD

And now, the final question. Which one is better: to overpay mortgage1 with $20,000 in month 13, or to put this $20,000 into a bank deposit that pays 5% yearly for the 19 years (roughly the remaining duration of the mortgage)?

(

getTotalCostDiff(mortgage1, Dict(13 => 20_000)) |> fmt,

# fn from chapter about compund interest

getValue(20_000, 5, 19) - 20_000 |> fmt

)("40,972 USD", "30,539 USD")So if the calculations were accurate in this scenario we would have saved (in nominal money) $40,972 in interests, whereas gained extra $30,593 (to our initial $20,000) on the bank deposit (compare with Section 18.2.1). Advantage over-payment.